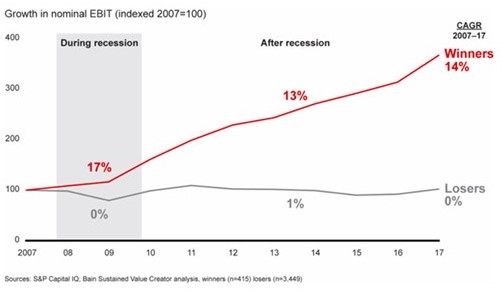

Inevitably, after every recession the economy grows again. Research by Bain & Company, Harvard Business Review, Deloitte, and McKinsey shows that the best companies continue to grow their EBIT during a recession and also accelerate faster after it when compared to other companies (see Figure 1). Let’s take a look at what the winners do differently to accelerate their profitability during and after a recession.

Figure 1. “Winning companies accelerated profitability during and after the recession, while losers stalled” (Source: Bain & Company).

7 Key actions to accelerate your profitability during and after a recession

We’ve integrated this research material to generate a clear picture of the 7 key actions you need to take for success.

1. Create clarity of direction and organisational alignment

How do you want your company to look and run in three to five years from now? And in one year? What are the vital few strategic initiatives to focus on? Make sure your leadership team is committed and fully aligned.

2. Understand your strategic and financial position

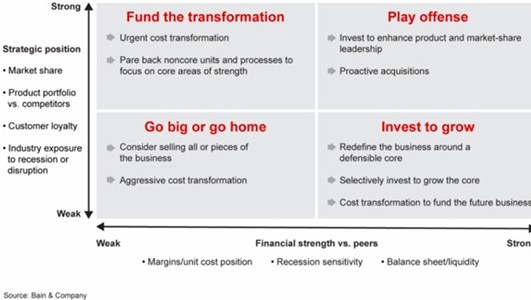

Mapping out your plans depends on your strategic and financial position

(see Figure 2).

Figure 2. Mapping out your plans requires an assessment of your company’s strategic and financial position (Source: Bain & Company).

3. Free up “currency”

This is not about blunt cost cutting; the focus is on aligning your spending with your vision and strategic initiatives. Zero-based Alignment / Budgeting is a good way to select and make lean those activities that are fully aligned. The “currency” you free up can strengthen your balance sheet and support your investment agenda.

4. Retain your customers

Retaining your customers is so much cheaper than acquiring new ones. The margin impact is significant. Explore ways to help your customers through the downturn and strengthen your relation with them. And be sure to focus on the right customers.

5. Plan for various scenarios

Nobody knows when and how a downturn will unfold and when the economy will start to grow again. The winners have developed various scenarios, and they know how they should act in each scenario. This allows them to move quickly and decisively.

6. Act quickly and decisively

Winning companies act quickly and decisively, both in the downturn and particularly in the early upturn when the opportunities start to arise. They have already created the “currency” to invest.

7. Embrace technology

Not all companies have been equally aggressive in adopting new technologies. There are many opportunities here for improving efficiency or generating more value and thereby gaining a competitive advantage. The current COVID19 pandemic could well be an important catalyst.

This means that you have to be prepared for an economic downturn to come out as one of the winners. It should be noted that in these key actions, there is, in fact, no difference between being prepared for an economic downturn and running a business for continuous and maximum success. This picture is consistent with one that emerges from one of our other articles “How to create value in Industrials?”.